What is actually a two Wheeler Mortgage EMI?

Two-wheeler fund try unsecured loans provided by finance companies without having any collateral such as your house, flat, assets, etc. Two-wheeler funds are often offered by repaired interest levels where rates of interest derive from your credit rating. The greater your credit score, the lower the interest and you will vice-versa. EMI is the amount determined during the time of choosing an effective consumer loan of the financial institution facing loan amount considering price of great interest and you will mortgage period.

A consumer loan exists at the a high interest than simply a secured loan on account of higher risk involved as you are not requested any collateral to be sure installment. This type of personal loans allow you to pay off him or her away from twelve to 72 months

When you take an unsecured loan, for every single EMI, that you will be required to pay monthly, include percentage toward dominating together with desire into the dominating. And therefore, the fresh new EMI of any unsecured loan try arranged in another way into the foundation out of Loan amount, Mortgage Tenure and you will Interest.

Two-wheeler Mortgage EMI Calculator

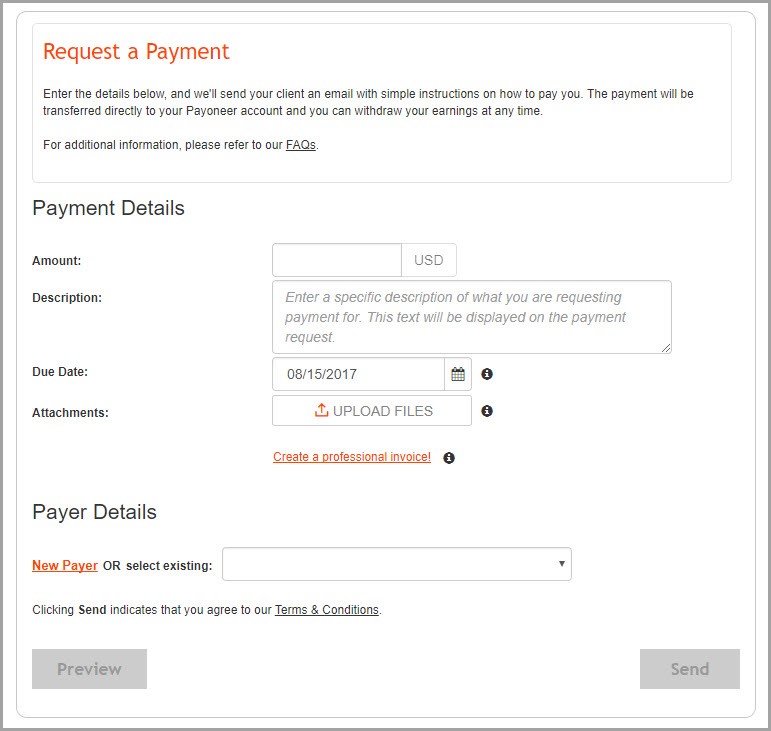

Look at the Codeforbanks webpage and select both Wheeler Mortgage EMI Calculator regarding Economic Calculator selection. You happen to be questioned so you’re able to enter in the next facts: Amount borrowed, mortgage tenure as well as the interest.

When you go into the three portion, new EMI Calculator can establish new EMI matter you must spend, you eters also to acquire a keen EMI option you to definitely finest serves your very own considered.

How does an enthusiastic EMI Calculator really works?

- Amount borrowed:This is the original count that an individual borrows off an effective financial or other financial institution. High the borrowed funds matter, the higher could be the EMI which you buy the new mortgage taken.

- Tenure: The fresh new considering time period for the payment of https://elitecashadvance.com/installment-loans-ks/chase/ your loan. Given that installment is accomplished every month, the brand new tenure is calculated from inside the weeks rather than years.

- Rate of interest: Here is the rate where appeal was recharged into amount borrowed. The rate may vary toward financial so you’re able to lender where you was taking the financing.

Great things about EMI Calculator

Before you even apply for financing, you have to know if you have the ability to see that loan. You can do this with the aid of an effective EMI Calculator. Calculating your EMI enables you to funds greatest to help you result in the EMI money punctually. One other advantages of new EMI Calculator were:

- Accessibility:That it online consumer loan calculator is available from anywhere out of one device.

- Accuracy: Playing with good EMI Calculator is far more appropriate than simply figuring the fresh new amounts on your own.

- Interest: As stated more than, EMI calculations should be over before you even begin your application for the loan. An excellent EMI Calculator makes it possible to with this particular.

- Timely Formula: Whenever you get into loan amount, tenure (into the days) and you can interest rate, they instantaneously computes the fresh new EMI into a click.

- Save your time: You need not do all the latest computations oneself or you are not required to wade anyplace for finding knowing the latest EMI number. It can display screen brand new EMI quickly.

- Amortization Dining table: Moreover it brings whole amortization table spanning having big date, principal, interest and you may EMI for the entire tenure. This is exactly toward monthly foundation. Guess you are taking tenure from 10 years (120 months), brand new dining table will include all the information to own complete 120 weeks.

Items Affecting Two-wheeler Financing EMI

Two-wheeler mortgage EMI tend to apply at by a number of situations because rely on amount borrowed, mortgage period and you can rate of interest. People change in such variables often impact the EMI matter. And this, new EMI of each consumer loan is actually arranged in another way for the base regarding Loan amount, Mortgage Period and Rate of interest.