First and foremost, the bonus is in the ease and you can availableness away from choice’. Playing with a large financial company can allow the fresh debtor to gain access to cost and facts https://paydayloanalabama.com/gordonville/ regarding several loan providers in the industry, providing alternatives and you will a real investigations. Without having any services out of a mortgage broker, the burden out of browse generally drops you.

Centered on multiple education, unfortuitously even today, almost 70% regarding Australian’s would zero fool around with a mortgage broker. That means 70% away from Aussies can be just thinking their financial contains the most readily useful tool and you will price or are trying to shop around by themselves, truly with lenders. This can be each other boring and confusing, because nowadays there are around 50+ bank and you may low-lender loan providers in australia. Do you really think enquiring myself which have 50 loan providers?

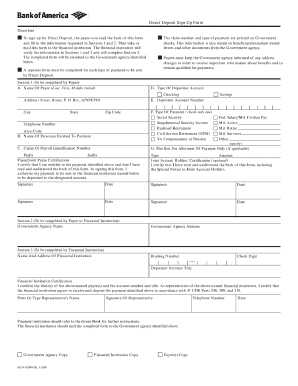

Advantage of playing with a mortgage broker No. 2: Some point of data admission

If you go they alone’ just be sure to complete pre-certification files with each private lender, any time you implement. This will be a monotonous take action when done shortly after, aside from half dozen minutes or fifty moments for many who must find a very good rates on your own in the place of a large financial company.

Using a large financial company allows you to carry out One(1) pre-certification software, that’s next generally speaking entered in their aggregator application. When they possess lodged that it, the computer backlinks having multiple lenders (commonly 20 50 loan providers, based upon who they really are licensed to do business with) and you may introduced the best possible cost and loans available from these types of loan providers. Then you certainly can sit-down together with your large financial company and determine a knowledgeable financial to you personally.

Benefit of having fun with a large financial company Zero. 3: No extra pricing

Many Australians do not realise your functions out-of a home loan broker is generally (unless pre-stated) Cost-free. The mortgage agent doesn’t need to cost you a fee since they are paid in the earnings of the bank they establish the loan having.

Such as, for people who submit an application for a mortgage with a large financial company and you may examine 20 lenders and choose Suncorp Financial commit which have, Suncorp Bank will pay the mortgage broker a commission getting providing the firm to Suncorp Financial. We accept that they want to shell out a fee so you’re able to the mortgage representative or at least capable have it decreased if they go yourself toward financial, but in most cases this might be false.

Advantageous asset of playing with a mortgage broker Zero. 4: Separate Pointers

If you bank that have a particular financial otherwise bank immediately after which strategy her or him for home financing, generally he or she is simply providing you with their best rate’ they own to you, not this new avenues finest rate. Also, for people who have home financing having a lender or financial, we can make sure your that they are not contacting both you and telling you one to other bank provides a far greater rate than just him or her, even when it might be in your best interest to learn this.

From time to time sitting yourself down which have a large financial company can be to save you thousands of dollars finally, purely because you score a entire market’ look at what’s offered and best for your requirements.

We’ve got viewed sometimes up to a step 3% difference for the mans mortgage rates ahead of i refinance them. Like Sarah are into the an excellent step three.65% price just before we discover this lady a 1.95% refinance speed preserving her thousands per year and potentially years regarding the lady mortgage. This lady bank’s finest rate for her try step three.65%, but this was maybe not the new markets greatest rates on her. As opposed to talking to a mortgage broker, she’d become overpaying several thousand dollars inside focus along the longevity of the loan.